solutions

what we do

Customers & Partners

We make claims handling easy.

At the heart of the business is claims handling, it’s at this stage that the insurance company meets its commitments to its customers, sets standards of service, drives credibility, and fullfils its obligations. Enabling insurance companies to more effectively handle claims in a digital and automated way, Upptec accelerates the claims handling process with focus on the digital user experience and the customer journey.

And yes, this is what we can help you with.

Solutions

From phygital to full STP

For claims adjusters

Upptec is a way for insurers to go digital while maintaining a human touch!

For policyholders enabled by claims adjusters

A short-cut to automated claims – with minimum effort and time spent

For policyholders

A seamless digital journey with a fully automated STP offering

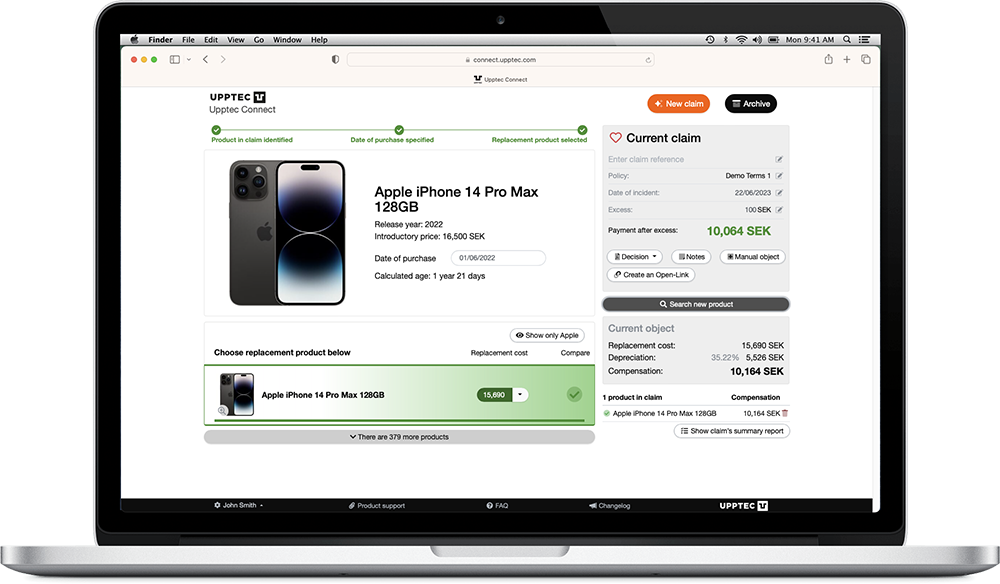

Upptec Connect

Upptec is a way for insurers to go digital while maintaining a human touch!

Identifying the correct item/products, finding the correct price and calculating the settlement value are the main tasks for a claims adjuster. This is often a challenging and time-consuming process where accuracy is of utmost important to gain the policyholders trust.

Digital claim valuation empowers the Claims Adjuster to make remote transparent valuation of the customers claim and instant settlement. This will increase operational claims adjuster utilization, and provide the attractive customer experience required to stay ahead in a competitive market.

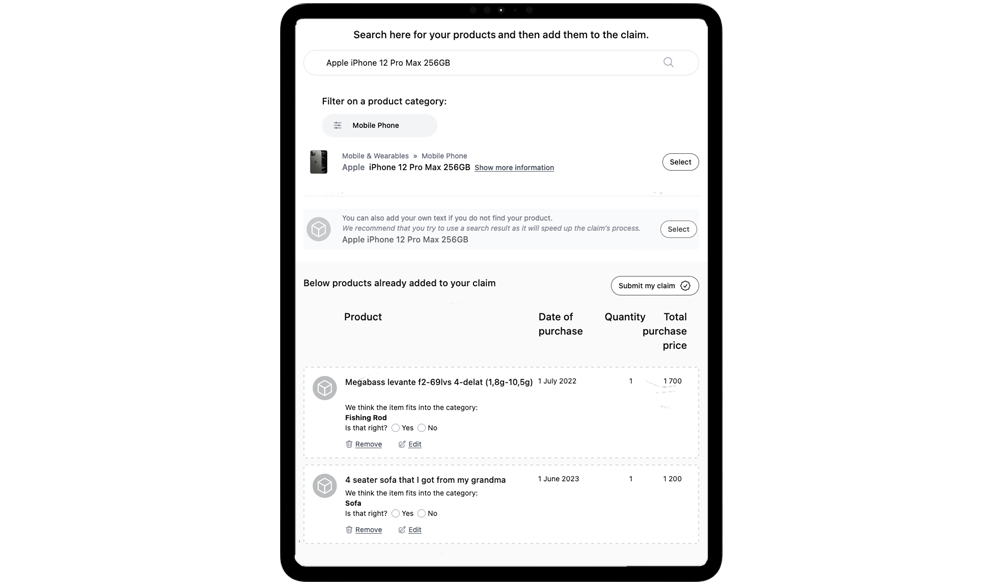

Upptec Open-Link

A short-cut to automated claims – with minimum effort and time spent

In short, Upptec Open-Link is a short-cut to completely automate your claims management process.

Open-Link makes it possible to create and send a link to the policyholder.

The claimant can then file contents directly into the reported claim. This solution provides an easy fix for both small and complex claims. The policyholder fills Open-Link from anywhere at any time.

Using Open-Link will significantly decrease development time and solution complexity.

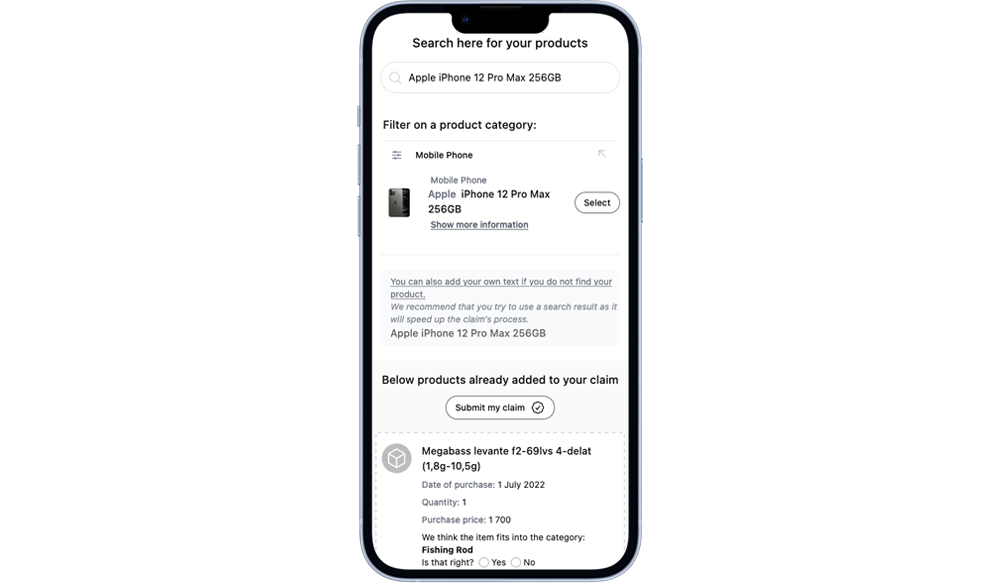

Upptec Direct

A seamless digital journey with a fully automated STP offering

Creating a seamless and digital customer experience will determine a carrier’s success in the years to come. Claim handling is the core of every carrier’s operation – and by leaving legacy technology behind – opens an opportunity to boost both your customer’s experience and process efficiency.

Upptec Valuation Self-Service enables instant, accurate and fair settlement of content claims, creating a 24/7 straight-through-process (STP) capability in the channel preferred.

This is how it actually works

Cutting-edge Technology

Digital technologies are enabling innovative insurers to meet and even drive customer expectations, giving them a powerful advantage.

Our cutting-edge technology handles claims content automation 24/7, which requires responsive and stable systems. We have selected one of the most stable technologies in the world, Elixir/Erlang, to guarantee quick response times and the absolute highest availability.

We have extensive documentation for our RESTful JSON API that provides straight-through-process (STP) capability and functionality for integration into corporate core systems.

Your developers will have something up and running in a matter of days.

The ultimate guide to claims automation

We do not want the insurance industry to stay behind, which is why we have created the ultimate guide to claims automation.